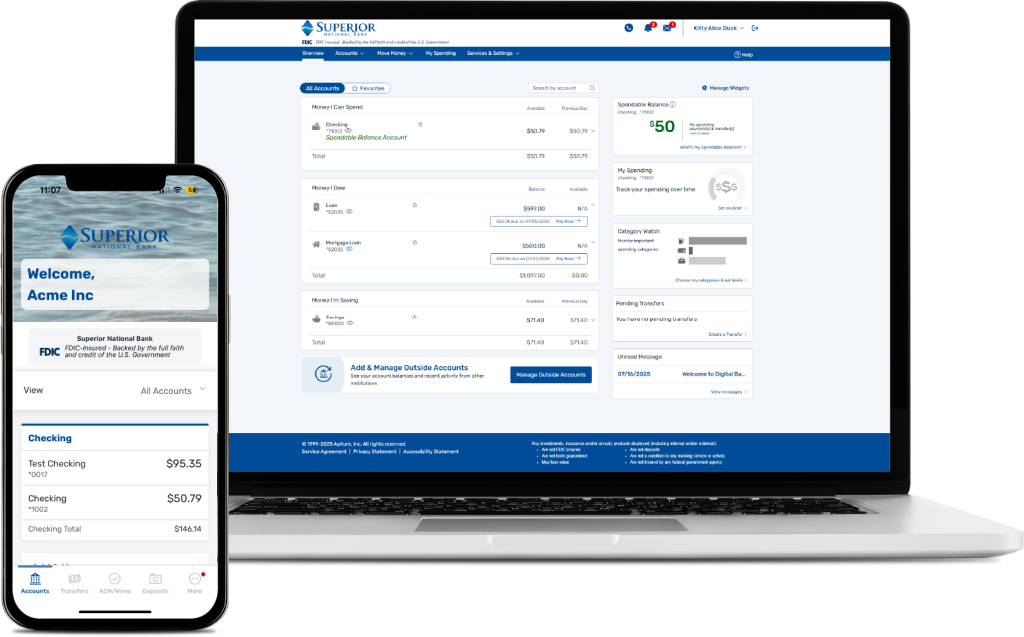

A Superior Digital Banking Experience Is Now Here!

Use the buttons below to download the new mobile app. Online banking can be accessed through our home page here. For guidance in logging into your account, please view the helpful resources section below. If you need additional support, please call us at 866.482.0404.

Improved Look and Feel

Seamless Experience

Digital Payments

Grow Your Future

Helpful Resources

Consumer Customers

Accessing Your Accounts Starting Monday, September 22nd

Beginning Monday, September 22nd, you can access your accounts through our new digital banking platform by following these steps:

- Mobile Users: Download the new SNB Mobile App from the Apple App Store or Google Play Store. Enter the same user ID and password used to access your accounts previously and follow the prompts to activate your new digital banking account.

- Desktop Users: Visit www.snb-t.com and click ‘Log In.’ Enter the same user ID and password used to access your accounts previously and follow the prompts to activate your new digital banking account.

- There are multiple options to see the accounts that are important to you. You can set the accounts you want to see by marking them as Favorites. You can also hide accounts completely by navigating to the Services & Settings tab > Modify Access & Services and choose to Remove Access for any accounts you no longer wish to see.

Once you’ve successfully downloaded and logged into the new app, don’t forget to delete the old app from your device to avoid any confusion.

Bill Pay

You will notice a fresh new look to your enhanced Bill Pay dashboard, including more scheduling options and a new feature enabling you to send electronic payment to an individual. A few things to note for active Bill Pay users:

- Customers who have made a payment using Bill Pay in the last 18 months will be automatically enrolled for Bill Pay on our new digital platform. Others can self-enroll at any time.

- Your recurring and scheduled fixed dollar payments will continue to process as usual.

- Fluctuating payments whose amount due is communicated periodically to SNB by a merchant or utility provider (known as eBills) will need to be created again in our new Bill Pay system.

- You will find all your Bill Pay payees ready for you in our new digital banking platform.

- Your Bill Pay history will be viewable on our new platform after the end of business on Monday, September 22nd. All Bill Pay payments are viewable transactions in your account history.

We encourage customers to check that all payments process as expected after the move to our new digital banking platform.

Person-to-Person (P2P) Payments

We’re excited to offer two new convenient and secure ways to send money to friends and family.

- Zelle®: We’ve partnered with Zelle®, a trusted leader in person-to-person payments, to make sending and receiving money fast and easy.

Access Zelle by selecting “Move Money | Zelle®” in online banking or tapping the “Transfers” button in your mobile app.- Learn more about Zelle® here: snb-t.com/zelle

- Enhanced Bill Pay: Our upgraded Bill Pay system also includes new options to pay individuals directly, giving you even more flexibility when managing your payments.

Greenlight®

We’ve partnered with Greenlight®, the family finance app that gives kids their very own debit card! It’s a smart, simple way to help kids and teens build healthy money habits, while giving parents oversight and control as they manage the account through the Greenlight® App. Best of all, SNB customers can access Greenlight® for free* when linking their checking account.

New users can sign up directly through the SNB mobile app, while existing Greenlight® customers should call Greenlight® customer support at 888.483.2645 for assistance.

Learn more at snb-t.com/greenlight.

Internal Transfers

Our new digital banking platform offers plenty of easy to navigate options to transfer funds between your SNB deposit accounts and loans. We have migrated most transfer settings to your new banking environment, but a few items may require your attention:

- You can continue to make one time transfers through our current online and mobile banking platforms until Friday, September 19th at 5:00 PM ET.

- Please do not schedule any new recurring transfers after Monday, September 8th. Recurring transfers can be scheduled on our new platform beginning Monday, September 22nd.

- If you need assistance transferring funds during the transition period, please call us at 866.482.0404 – we’re happy to help.

- Recurring transfers between SNB deposit accounts will need to be reestablished.

- Recurring regular payments from an SNB deposit account to an SNB loan will continue to process as scheduled.

- Recurring principal only payments from an SNB deposit account to an SNB Loan will need to be rescheduled.

Only transfers created within SNB Bank’s digital banking system will be affected.

External Accounts

Make SNB your central hub for managing finances—even across institutions.

- To link external accounts for transferring funds, log in to the web version of online banking, click “Move Money”, then select “Add External Transfer Account.”

- Once enrolled, you can transfer funds using both the web and mobile platforms.

- Recurring transfers between an SNB deposit account and an account at another financial institution will need to be reestablished.

Note: While external accounts must be added through the web to enable transfers, you can still link them in the mobile app as view-only for easy monitoring.

External accounts that were previously connected to your SNB account will need to be reconnected after Monday, September 22nd.

Budgeting Tools

You will find all new tools to assist you with budgeting and personal finance:

- My Spending allows you to categorize your expenses and set limits in each category.

- The Spendable Balance widget lets you carve out funds that are needed to meet regular expenses or savings goals, giving you a clearer picture of your discretionary dollars.

- You will also be able to connect your new SNB banking platform to popular third-party budgeting tools like Yodlee, YNAB, Finicity, etc.

Consumer & Mortgage Loans

Stay on top of your loans with quick access to payment information, interest rates, maturity dates, and more—right within your new digital banking experience.

- Make regular payments or principal only payments online or in the app.

- Transfer funds from your Line of Credit to deposit accounts.

- Please reference the ‘Internal Transfers’ section of this page if you have previously scheduled loan payments through your online banking.

Debit Card Controls

Safeguard your accounts with tools to monitor and restrict your debit card.

- You can turn on/off your card, set spending limits and more!

- To get started, navigate to More > Card Center.

- You can also control your card through online banking on your desktop via the Card Center tab.

Note that previous settings or alerts may need to be reestablished.

Alerts

You can customize email, text, or push alerts to help monitor accounts and spot trouble quickly.

- Security and account alerts can help you stop fraud and keep watch on your transactions, balances, and more.

- Alerts established in our sunsetting digital platform will need to be recreated in our new platform, as your menu of available alerts has changed.

Electronic Statements

Electronic statements are an eco-friendly way to store your banking records and still have them available wherever and whenever you need them.

- If you had electronic statements on our legacy platform, please be sure to re-enroll on our new platform. You can do so by navigating to Services & Settings > View Statements & Documents.

- If you would like to enroll in electronic statements you can do so in the app or web-based banking.

- Eighteen months of statements are available for each enrolled account.

- Electronic statements from our sunset digital platform will be available in the new platform.

Business Customers

What do I need to do to access my business accounts beginning Monday, September 22nd?

Beginning Monday, September 22nd, you can access your accounts through our new digital banking platform by following these steps:

- Mobile Users: Download the new SNB Mobile App from the Apple App Store or Google Play Store. Enter your existing user ID (in all caps) and password used to access your accounts previously and follow the prompts to activate your new digital banking account. You will no longer need to use a Company ID to log in.

- Desktop Users: Visit www.snb-t.com and click ‘Log In.’ Enter your existing user ID (in all caps) and password used to access your accounts previously and follow the prompts to activate your new digital banking account. You will no longer need to use a Company ID to log in.

Once you’ve successfully downloaded and logged into the new app, don’t forget to delete the old app from your device to avoid any confusion.

Digital Banking Administration

Our new digital platform empowers you to set custom user controls that make sense for your business. Each digital banking account has an Administrator that can create additional sub users and edit their individual permissions and access.

- The same user will be the Administrator for the business’s digital banking platform.

- Active sub users created before Monday, September 8th will have a profile established in the new digital banking platform and will retain all the same access and permissions. Sub users created after September 8th will need to be recreated in the new platform on or after Monday, September 22nd.

Internal Transfers

Our new digital banking platform offers plenty of easy to navigate options to transfer funds between your SNB deposit accounts and loans. We have transferred most of your transfer settings to your new banking environment, but a few items may require your attention:

- You can continue to make one time transfers through our current online and mobile banking platforms until Friday, September 19th at 5:00 PM ET.

- Please do not schedule any new recurring transfers after Monday, September 8th. Recurring transfers can be scheduled in our new platform beginning Monday, September 22nd.

- If you need assistance transferring funds between during the transition period, please call us at 866.482.0404 – we’re happy to help.

- Recurring transfers between SNB deposit accounts will continue to process as scheduled.

- Recurring regular payments from an SNB deposit account to an SNB loan will continue to process as scheduled.

- Recurring principal only payments from an SNB deposit account to an SNB Loan will need to be rescheduled.

- Recurring transfers between an SNB deposit account and an account at another financial institution will need to be reestablished.

Only transfers created within SNB Bank’s digital banking system will be affected.

External Accounts

Make SNB your central hub for managing your finances—even across institutions.

- To link external accounts for transferring funds, log in to the web version of online banking, click “Move Money”, then select “Add External Transfer Account.”

- Once enrolled, you can transfer funds using both the web and mobile platforms.

Note: While external accounts must be added through the web to enable transfers, you can still link them in the mobile app as view-only for easy monitoring.

Bill Pay

You will notice a fresh new look to your enhanced Bill Pay dashboard, including more scheduling options and a new feature enabling you to send electronic payment to an individual. A few things to note for active Bill Pay users:

- Digital Banking Administrators will need to review sub-user entitlements and assign Bill Pay to users as appropriate on or after Monday, September 22nd.

- Customers who have made a payment using Bill Pay in the last 18 months will be automatically enrolled for Bill Pay on our new digital platform. Others can self-enroll at any time.

- Your recurring and scheduled fixed dollar payments will continue process as usual.

- Fluctuating payments whose amount due is communicated periodically to SNB by a merchant or utility provider (known as eBills) will need to be created again in our new Bill Pay system.

- You will find all your Bill Pay payees ready for you in our new digital banking platform.

- Your Bill Pay history will be viewable on our new platform after the end of business on Monday, September 22nd. Also, all Bill Pay payments are viewable transactions in your account history.

We encourage customers to check that all payments process as expected after the move to our new digital banking platform.

Card Controls – Business

Safeguard your accounts with tools to monitor and restrict your debit card.

- Business debit cards can be enrolled in Card Suite Lite, our new stand-alone card control app.

Note that previous settings or alerts may need to be reestablished.

Business Loans & Lines of Credit

The upgraded platform gives you greater insight and control over your SNB business loans:

- View loan details: payment status, interest rate, maturity date, and more.

- View and make payments in web-based or mobile banking.

- Apply principal-only payments if desired.

- Please reference the ‘Internal Transfers’ section of this page if you have previously scheduled loan payments through your online banking.

ACH Origination

ACH Origination allows business customers to initiate electronic credit or debit entries into the ACH network. This service can be used for things like payroll and accounts payable/receivable. Our ACH Originators will enjoy powerful tools to securely and efficiently process electronic payments. To prepare for this platform change, please take note of the items below:

- You will be able to schedule ACH files on our sunsetting platform until Friday, September 19th at 4:00 PM ET. Beginning Monday, September 22nd, you will be able to send ACH files on our new platform.

- ACH files with effective dates after Monday, September 22nd need to be submitted on the new platform on or after Monday, September 22nd.

- Your ACH templates created on or before Monday, September 8th will be built and ready for use on our new platform. Any templates created or edited after Monday, September 8th will need to be re-created/edited in the new platform on or after Monday, September 22nd.

- Recurring ACH transactions will not be transferred to the new platform and will need to be recreated on or after Monday, September 22nd.

- The daily cut-off time will continue to be 4:00 PM ET.

- You will have access to ACH activity in your account history, available to you on our new digital banking platform. We can provide detailed information regarding any previously processed ACH files as needed.

- You will be able to view return and Notification of Change (NOC) information within digital banking by navigating to the Fraud Control>Positive Pay/ACH Reports area. Note you do not need to utilize Positive Pay services to view your return and NOC notifications.

- You can request to process a reversal file by navigating to the Payments & Transfers Tab > ACH Activity, select the three ellipses and choose Request Reversal. As a reminder, reversal files must be processed within 5 days of the effective date.

- To Import your ACH files on our new platform starting Monday, September 22nd, navigate to the Payments & Transfers Tab > NACHA File import.

- Please see some helpful resources below:

Please contact our Treasury Management team with additional ACH questions:

- Email: treasurymanagement@snb-t.com

- Call: 866.482.0404

Positive Pay

Positive Pay is an anti-fraud tool that provides businesses control over checks and ACH transactions clearing their accounts. Positive Pay users will be thrilled with the enhancements to this essential security tool. Here are a few things to note about this revamped service:

- Check Positive Pay will now validate the payee of the check in addition to the amount of the check and other items.

- Digital Banking Administrators will need to review sub-user entitlements and assign Positive Pay to users as appropriate on or after Monday, September 22nd.

- ACH Positive Pay will now allow users to accept or reject ACH credits posting to your account.

- Email and text alerts can be created to notify you of exceptions awaiting to be review and decision.

- Users will be able to process exceptions on the web-based or mobile versions of the new platform.

- Outstanding check files and ACH blocks/filters will be transferred to the new platform.

- Deadlines for reviewing and decisioning exception items are as follows:

- Checks: 11:00 AM ET

- ACH: 3:00 PM ET

- Approvers will continue to process exceptions on our legacy platform through Friday, September 19th.

- Exceptions will be processed on the new platform beginning Monday, September 22nd.

- Starting Monday, September 22nd, you will upload your outstanding checks into the new platform.

- New ACH filters/blocks can be created on our new platform starting on Monday, September 22nd.

- For step-by-step instructions detailing how to use our new Positive Pay platform, see the tutorials below.

- ACH Pos Pay Guide PDF

- Check Pos Pay Guide PDF

- ACH Pos Pay – Adding To Approve – Block List PDF

- ACH Pos Pay – How to Decision Items PDF

- Check Pos Pay – How to Decision Items PDF

- Setting Up Notifications in Positive Pay PDF

- How to Entitle a User to Pos Pay

- Manually Adding Issue Check Items

- Uploading Issue Items in Check Pos Pay

Please contact our Treasury Management team with additional Positive Pay questions:

- Email: treasurymanagement@snb-t.com

- Call: 866.482.0404

Quicken and QuickBooks Users

If you currently connect your digital banking transactions to Quicken or QuickBooks, there are some steps you will need to take before and after our launch date to ensure a smooth transition. See below for helpful instructions to ensure you are prepared.

- QuickBooks Desktop Conversion Instructions

- QuickBooks Online Conversion Instructions

- Quicken Conversion Instructions

Please contact our Treasury Management team with any additional questions:

- Email: treasurymanagement@snb-t.com

- Call: 866.482.0404

Autobooks Users

As part of the upcoming Digital Banking upgrade, we want to ensure you continue to have uninterrupted access to your Autobooks services.

SNB is working with our new Digital Banking platform to provide easy, secure access within your Digital Banking. However, until that integration is complete, you can maintain access to your existing Autobooks account via a direct login to their platform.

The Autobooks team will assist you in establishing your direct login so that you can continue sending invoices, accepting payments, and managing your business finances seamlessly.

To set this up prior to conversion weekend (which will begin Friday, September 19) please contact Autobooks at:

- Email: support@autobooks.co

- Call: 866.617.3122

Wire Transfers

Business customers who take advantage of our convenient self-service wires will find a simple, intuitive tool set. A few things to note:

- Online wire processing will be available on the sun setting platform until 3:00 PM ET on Friday, September 19th, and will be available on our new digital platform beginning on Monday, Monday, September 22nd.

- Wire templates created on or before Monday, September 8th, will be built and ready for you on the new business digital banking platform. Templates that are created or modified after this date will need to be created or modified again on the new platform on or after Monday, September 22nd.

- The cut-off time for same-day processing will continue to be 3:00 PM ET.

- For step-by-step instructions and a video demonstration detailing how to initiate wires in our new platform, please view the resources below:

Please contact our Treasury Management team with additional wire questions:

- Email: treasurymanagement@snb-t.com

- Call: 866.482.0404

Remote Deposit Capture (RDC)

RDC is a helpful tool that allows business customers to deposit checks remotely using self-service scanners. RDC clients will move to an updated processing platform prior to the launch of our new digital banking platform.

- A key benefit of the platform change is an extension of the cutoff time for same day deposit credit to 6:00 PM ET (Previously 4:00 PM ET).

- RDC customers will migrate to the new processing platform between Monday, August 25th and Friday, September 12th.

- Customers will not be able to process deposits on the legacy RDC platform after Friday, September 12th.

- Your existing hardware will continue to function with the new platform.

- Your deposit information will be in your account history on the new platform. However, if you would like the deposit detail reports from the legacy system, we recommend you download them prior to migrating.

- We can provide detailed information on historical RDC deposits upon request.

- For step-by-step instructions and video demonstrations regarding our RDC platform change, please view the resources below.

- A variety of tutorial videos can be found here.

- Creating and Submitting Deposits – Not Using RDC+ PDF

- Creating and Submitting Deposits on RDC+ PDF

Please contact our Treasury Management team with additional RDC questions:

- Email: treasurymanagement@snb-t.com

- Call: 866.482.0404

Additional Resources

How To Guides

We have developed a variety of “How To” guides for you to reference. Please see below:

- How to Create Reports PDF

- How to Request Treasury Management Services PDF

- How to Reset Your Passcode PDF

- How to Self Enroll for Digital Banking PDF

- How to Setup Alerts PDF

- How to Change Contact Information PDF

- How to Change Your Access ID PDF

- How to Create a Sub-User PDF

If you have any additional questions please contact us at 866.482.0404.

Video Tutorials

Videos coming soon.

If you need assistance please call 866.482.0404.

Disclaimers: The Greenlight card is issued by Community Federal Savings Bank, member FDIC, pursuant to license by Mastercard International.

*Superior National Bank customers are eligible for the Greenlight SELECT plan at no cost when they connect their Superior National Bank account as the Greenlight funding source for the entirety of the promotion. Subject to minimum balance requirements and identity verification. Upgrades will result in additional fees. Plans start at $5.99/mo. Upon termination of promotion, members will be responsible for associated monthly fees. See terms for details. No expiration date currently applies to this offer. Offer subject to change or renewal. Card images shown are illustrative and may vary from the card you receive.